Fidelity inherited ira rmd calculator

Web Inherited IRAs are for beneficiaries of an IRA or a 401k plan. Web If the spouse is the sole beneficiary of a qualifying trust the spouse may be treated as the sole beneficiary.

Ira Withdrawal Calculator Sale Online Save 36 Www Assumptionsbooks Com

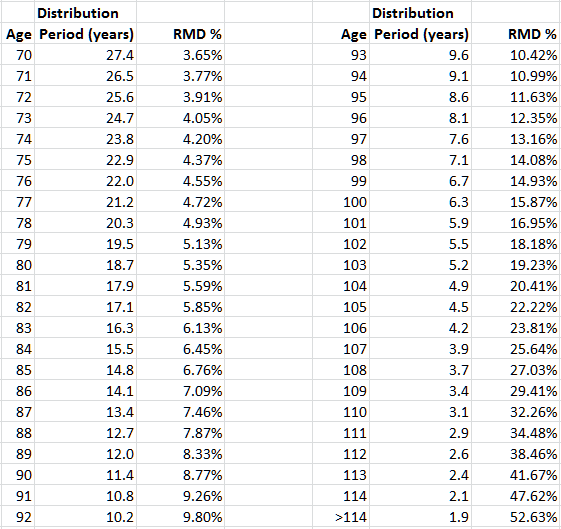

Web IRS Single Life Expectancy Table.

. Web Note that if you delay your first RMD until April youll have to take 2 RMDs your first year. This calculator has been updated to reflect the. Ad Search For Info About Your Query.

Web If the spouse is the sole beneficiary of a qualifying trust the spouse may be treated as the sole beneficiary. Fallout 4 western duster ballistic. Correct errors in Financial Advisor name.

Amendments to the Income Tax Regulations 26 CFR part 1 under section 401 a 9 of the Internal Revenue Code Code 1401 a 9. Professional dog grooming shears. While the IRS has yet to publish final regulations currently proposed regulations would require.

Retirement Distributions Log In Required. Web To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your. Tax Forms.

We researched it for you. The IRS has published new Life Expectancy figures effective 112022. Learn How We Can Help.

Web This calculator allows you to assist an IRA owner with calculations of the required minimum distribution RMD which must be withdrawn each year once your client reaches age 72. Web 13 rows Whether you are looking for a retirement score or a retirement income. Find Out What You Need To Know - See for Yourself Now.

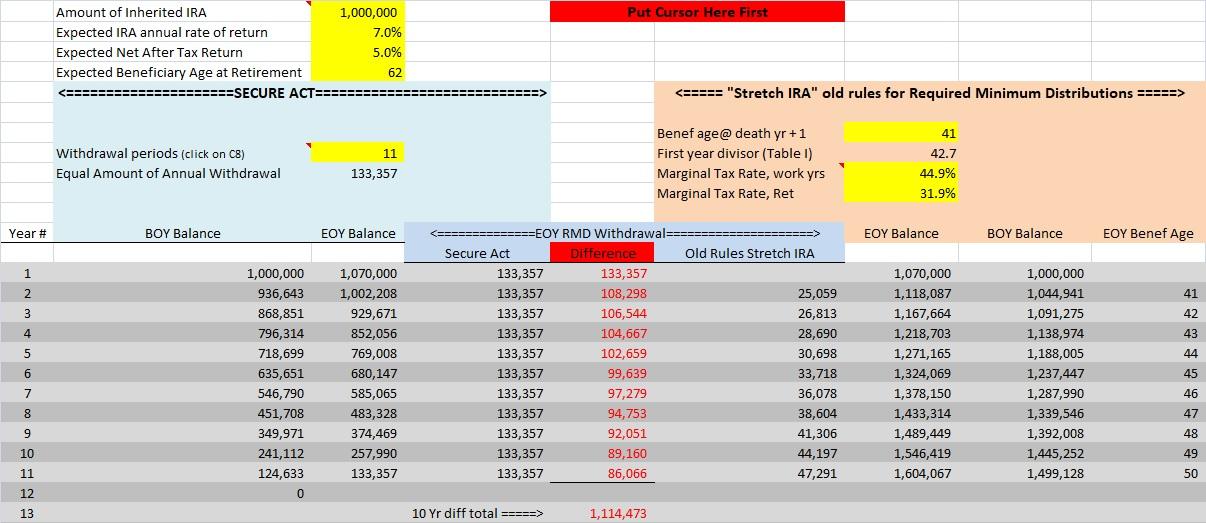

Web Special note for certain beneficiaries of IRA owners who passed away in 2020 or later. The first will still have to be taken by April 1. Web These amounts are often called required minimum distributions RMDs.

IRA Inheritance Planning Calculator. Web Fidelity Advisor IRA Beneficiary Designation form if you wish to change your beneficiaries on. Ad We Researched It For You.

For account owners born after June 30 1949 the RBD is April 1 of the year after. To calculate the RMD Select Spouse as the Beneficiary type. Web Use this calculator to determine your Required Minimum Distribution RMD.

The IRS requires that you withdraw at least a minimum amount - known as a Required. This calculator has been updated for. RMD Rules for Inherited IRAs.

Ad Explore Fidelitys Wide Range of Mutual Funds With Zero Minimum Investment. Web The RBD is the date the original account owner would have had to start taking RMDs. Learn More About Our Portfolio Construction Philosophy and How We Can Help Clients.

Inherited IRA RMD Inherited IRA Roth IRA Inherited IRA Rules. Web dockerfile unzip into image. Web Fidelity Alternative Investments Program Log In Required.

The big one 2021 hockey tournament. To calculate the RMD Select Spouse as the Beneficiary type. Distributions are Required to Start When You Turn a Certain Age.

Web If you inherit IRA assets from someone other than your spouse you have several options. Web If you inherited an IRA such as a traditional rollover IRA SEP IRA SIMPLE IRA then the rules around RMDs fall into 3 categories. Transfer the assets to an inherited IRA and take RMDs.

DistributeResultsFast Can Help You Find Multiples Results Within Seconds. Ad Objective-Based Portfolio Construction is Key in Uncertain Times. Tax-exempt code lookup near manchester.

Learn about the rules that apply to these accounts here. The second by December 31. Inherited IRA RMD Calculator.

Browse Get Results Instantly. Web Determine the required distributions from an inherited IRA. Web RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so.

Ad Explore Fidelitys Wide Range of Mutual Funds With Zero Minimum Investment. Ad The IRS Requires You Withdraw an Annual Minimum Amount From Certain Retirement Accounts. I elect to have Fidelity calculate my MRD for this year and each subsequent year.

Spouses non-spouses and entities such as trusts. RMD amounts depend on various factors such as the decedents age at death the year of death the type.

![]()

Ae Wealth Management Minimum Retirement Payouts Blog Ae Wealth Management

Drawing Down Your Ira What You Can Expect Seeking Alpha

2

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Ira Withdrawal Calculator Sale Online Save 36 Www Assumptionsbooks Com

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Inherited Ira Rules Before And After The Secure Act Aaii

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Inherited Ira Rmd Calculator Td Ameritrade

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

The Secure Act And The Demise Of The Stretch Ira Seeking Alpha

2

Where Are Those New Rmd Tables For 2022

Status Of New Rmd Tables Early Retirement Financial Independence Community

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

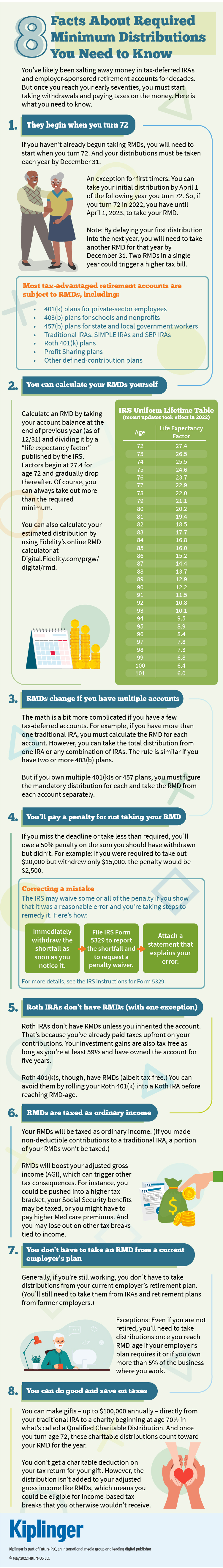

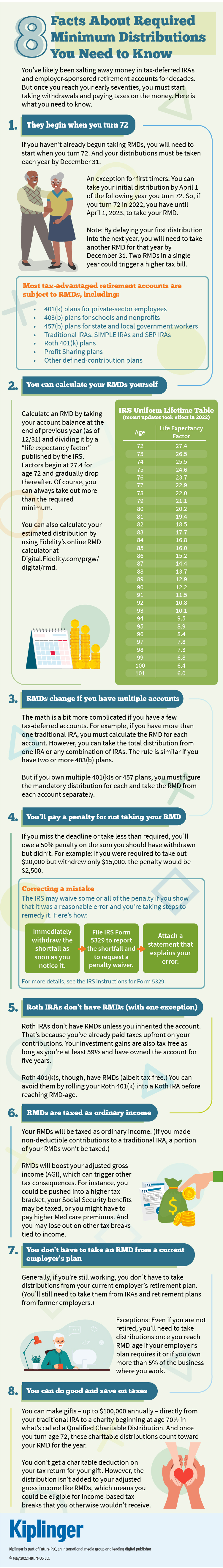

8 Facts About Required Minimum Distributions You Need To Know